Vehicle manufacturers and commercial fleets are investing in hydrogen-powered trucks as a solution to addressing climate emissions and other air pollutants from heavy-duty vehicles.

However, hydrogen trucks face several barriers to becoming an affordable, zero-emissions solution.

This explainer helps address frequent questions about the potential benefits and challenges of hydrogen-powered trucks.

Hydrogen-Powered Heavy-Duty Trucks

This is a condensed, online version of the report. For the full text and figures, please download the full report.

Vehicle manufacturers and commercial fleets are investing in hydrogen-powered trucks as a solution to addressing climate emissions and other air pollutants from heavy-duty vehicles. However, hydrogen trucks face several barriers to becoming an affordable, zero-emissions solution.

This explainer helps address frequent questions about the potential benefits and challenges of hydrogen-powered trucks.

Introduction

Heavy-duty trucks and buses are responsible for a disproportionate amount of vehicle pollution on roads and highways. Despite constituting just 10 percent of the vehicles on US roads, heavy-duty trucks and buses (Class 2b-8) emit over one-quarter of global warming emissions, around one-half of smog-forming nitrogen oxides (NOx), and over half of all fine particulate matter (PM2.5) from on-road vehicles (O’Dea 2019).

Reducing pollution from trucks and buses is paramount to creating a sustainable and equitable transportation system and electrifying heavy-duty vehicles is the best way to do this. Battery-electric vehicles (BEVs) represent the most common zero-emissions vehicle (ZEV) technology available today, with hundreds of thousands of trucks and buses deployed worldwide and an increasing number of models becoming available. However, trucks and buses powered by hydrogen are also part of the worldwide transportation electrification trend.

This explainer will help decisionmakers, researchers, and the public better understand the current state of heavy-duty hydrogen vehicle technologies and economics, as well as key considerations regarding the potential benefits and challenges of hydrogen vehicles, fuel, and fueling infrastructure. Current hydrogen production presents serious health concerns for communities and the environment, and truly zero-emissions hydrogen trucks face several barriers, including lower energy efficiency and higher fueling costs compared to battery-electric options. However, given the emerging state of hydrogen vehicle markets and fueling infrastructure build-out, and recent federal investments, hydrogen fuel-cell trucks may be deployed in some trucking applications in the coming years (McNamara 2022). Because hydrogen vehicles have the potential to both perpetuate and mitigate climate change and air pollution, the technology must be deployed only in ways that prevent continuing the existing harms of fossil fuels and lead to clear public health and environmental benefits.

Are Fuel-Cell Electric Vehicle Trucks Really Zero-Emissions Vehicles?

Yes—they can be, but it depends on how a fuel-cell electric vehicle’s (FCEV) hydrogen fuel is produced.

Zero-emissions trucks and buses on the market today come in two varieties: BEVs and hydrogen FCEVs. These two types of ZEVs share similarities and differences. With the anticipated and much-needed transition to zero-emissions trucks and buses worldwide, it is important to understand how these two technologies function so that they are applied in ways that maximize their individual advantages and reduce potential harms.

Like BEVs, FCEVs produce no tailpipe pollution while driving. However, the production of fuels that power each vehicle type—electricity and hydrogen—can emit global warming emissions and air pollution. Just as BEVs get cleaner as the grid gets cleaner, it is important to consider the life-cycle pollution impacts of FCEV trucks, to get a full picture of their potential to reduce global warming emissions and air pollution from freight operations (Reichmuth 2023). The following sections will cover some of the key upstream impacts of FCEV trucks and address some of the research around their ability to create a more sustainable freight system.

How Do Hydrogen-Powered Fuel-Cell Trucks Work?

An FCEV can be thought of as an electric vehicle with an onboard power plant. The FCEV’s hydrogen fuel cell converts hydrogen, stored on the vehicle in a high-pressure tank, into electricity. Like BEVs, FCEVs are powered using batteries, but they carry hydrogen fuel and a fuel cell to power the vehicle. Because of this design, typical FCEVs carry much smaller batteries than those found in an equivalent BEV, and FCEVs weigh significantly less. For example, a long-haul BEV tractor truck would likely have a battery over 1 megawatt and could travel several hundred miles before needing to recharge. A similar FCEV’s battery would be around one-tenth of that size, relying on the fuel cell and hydrogen stored on board to power the truck before hydrogen refueling would be needed.

Hydrogen Production Drives FCEV Pollution

While hydrogen FCEV trucks produce only water from the tailpipe, the production of hydrogen fuel can lead to significant life-cycle global warming emissions and air pollution, depending on how it is produced (Longden et al. 2022; McNamara 2020). Today, most hydrogen fuel is produced from natural gas, which comes with significant climate change and air quality concerns (Hyunah et al. 2022). Although FCEVs tend to have fewer emissions associated with vehicle production, preliminary results from an upcoming International Council on Clean Transportation (ICCT) study suggests that a battery-electric tractor truck running on renewable electricity produces around 13 percent less global warming emissions over its lifetime compared to a similar fuel-cell truck running on hydrogen produced from renewables-powered electrolysis (i.e., “green” hydrogen), as shown in Figure 1 (O’Connell et al., n.d.). FCEVs that run on hydrogen produced from natural gas, however, have life-cycle climate warming impacts on a scale similar to today’s diesel trucks.

In the electrolysis process, hydrogen fuel is produced using electricity to split oxygen and hydrogen atoms from water. This can be a zero-emissions process if carried out using renewable electricity, such as wind or solar power, though a sizable amount of electricity is needed to run the electrolysis process (McNamara 2023). According to the US Department of Energy, however, only 1 percent of hydrogen produced in the United States today is produced by electrolysis, while 95 percent is produced from natural gas and the remainder from coal gasification (US DOE 2020; US DOE 2023a; US DOE 2023b). Truly zero-emissions hydrogen must be fossil fuel free in its production processes and avoid negative impacts on communities and the environment.

How Could Hydrogen Trucks Impact My Community?

Current hydrogen production practices emit a variety of air pollutants and present serious health concerns for both humans and ecosystems. Nearly all hydrogen fuel available today is produced from natural gas through steam reformation, which is responsible for the emission of a variety of air pollutants, including PM2.5 and NOx (Sun et al. 2019). Therefore, the benefits of reduced tailpipe pollution could be compromised by increased emissions from hydrogen production that occurs elsewhere.

Where a proliferation of hydrogen fuel-cell trucks operating in port-adjacent communities may help decrease air pollution in that neighborhood, growing demand for the hydrogen fuel may cause an increase in air pollution in communities adjacent to fuel production facilities. However, as discussed below, some manufacturers are considering producing vehicles that burn hydrogen fuel, instead of converting it to electricity in a fuel cell. These vehicles emit a variety of pollutants and could negatively affect air quality.

Hydrogen Combustion Technologies Are Polluting and Expensive

Some engine and vehicle manufacturers are interested in developing technologies for hydrogen combustion, often stating that this technology comes with air quality, climate, and economic benefits (Wolfe 2022). However, while burning hydrogen in internal combustion engines eliminates tailpipe carbon dioxide pollution, these vehicles still produce significant levels of air pollutants, such as ozone-forming nitrogen oxides. A recent study found that hydrogen combustion engines may emit quantities of lung-damaging fine particulates at rates even greater than gasoline vehicles (Thawko and Tartakovsky 2022).

Given that ground-level ozone and particulate matter are the primary pollutants of concern in many urban areas, and particularly in communities adjacent to freight operations, hydrogen internal combustion engine vehicles do not offer the emissions benefits of FCEVs or BEVs.

What is more, burning hydrogen is far less energy efficient than converting it to electricity in a fuel cell, so hydrogen internal combustion engine trucks have, by far, the highest per-mile operating costs among battery-electric, diesel, and hydrogen trucks (Basma et al. 2023). Because hydrogen internal combustion engine trucks burn the fuel rather than convert it directly to electricity in a fuel cell, these trucks are estimated to have fuel efficiencies even lower than that of today’s diesel trucks (Basma et al. 2023).

Fuel Costs Are a Primary Limiting Economic Factor for Hydrogen Trucks

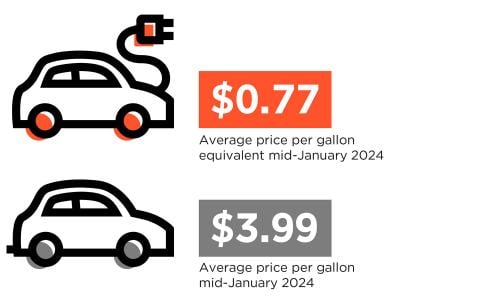

Operating expenditures for hydrogen-powered heavy-duty vehicles are much higher than those for other vehicle types because of the high cost of hydrogen fuel (See Figure 2). Studies have suggested that for FCEVs to compete economically with BEVs, green hydrogen fuel needs to be within a range of $3/kilogram (kg) to $6.50/kg by 2030 (Basma et al. 2023). In 2023, retail green hydrogen fuel prices in California hit around $30/kg, and reasonable estimates have suggested that at-the-pump prices will remain between $8/kg and $10/kg even with federal incentives (Collins 2023; S&P Global Commodity Insights 2023; Slowik et al. 2023). Although prices for electrolytic hydrogen may fall as supply production efficiencies increase, hydrogen fuel produced from natural gas will always share the volatilities of fossil fuels (Longden et al. 2022). High fuel prices may slow the development of fueling infrastructure, another key limiting factor for hydrogen fuel adoption in trucks.

FCEV trucks are likely to have somewhat higher purchase prices than similar BEVs, but fueling expenditures are likely to be the primary economic factor as fleets choose clean trucks. A recent ICCT study estimated that a battery-electric model year 2030 Class 8 tractor truck would outperform its FCEV equivalent in terms of per-mile cost by around 25 percent, an advantage driven primarily by fuel costs (Basma et al. 2023). Given that companies like Pepsi are conducting 400-plus-mile runs using battery-electric tractor trucks to haul fully laden loads over interstate mountain ranges, the ICCT study results suggest that FCEV trucks are most likely to be employed when duty cycle absolutely requires the extended range that FCEVs offer.

Even with upcoming hydrogen fuel subsidies from the Inflation Reduction Act, green hydrogen prices would need to drop precipitously for the technology to reasonably compete economically with BEVs (26 U.S.C. §45V; Ragon et al. 2023). Despite a surge of government support and private sector enthusiasm, the rate at which retail hydrogen prices fall is uncertain, but even under optimistic scenarios, it will be many years before prices fall enough to be competitive. While studies examining and comparing the lifetime costs of fuel-cell and battery-electric trucks return varying results, many studies agree that battery-electric trucks will reach total-cost parity sooner than fuel-cell trucks (Basma et al. 2023; CARB 2021; Rout et al. 2022; Slowik et al. 2023). Furthermore, studies that rely on more realistic and conservative hydrogen fuel costs tend to show limited nationwide adoption of hydrogen trucks, even in the long-haul sector (Basma et al. 2023; Ragon et al. 2023).

How Efficient Are Fuel-Cell Trucks?

As the transition to zero-emissions cars and trucks accelerates, policymakers should consider the vehicles’ overall fuel and energy efficiency. Ultimately, efficiency will be a primary driver of the amount of renewable electricity needed to power transportation systems.

Today, both battery-electric and fuel-cell trucks are more energy efficient than diesel trucks; however, BEVs have a distinct advantage over FCEVs in that they store energy directly in their batteries without requiring any intermediate steps. This BEV feature, often referred to as “direct electrification,” has both environmental and economic upsides, given that using electricity to create hydrogen from water and then converting it back to electricity in vehicles comes with significant energy efficiency loss (See Figure 3). A recent study of European alternative-fuel freight trucks found that a BEV truck can travel three times as far as an FCEV using the same amount of renewable energy (See Figure 4) (O’Connell et al. 2023). This is, in part, because of energy lost during hydrogen fuel production.

Although today’s FCEV trucks lag in efficiency, they do offer the upside of reduced vehicle weight and related increased load capacity. This reduced powertrain weight allows Class 8 long-haul FCEVs to transport an amount of freight equivalent to what a similar diesel-powered truck would transport. The extra weight associated with the large batteries required for a long-haul BEV tractor reduces the maximum amount of freight they can carry. While early prototype long-haul tractor BEVs have a weight penalty as high as 25 percent, advancements in battery technology over the next decade are anticipated to reduce battery weight, which will bring the maximum amount of freight able to be transported by a BEV truck to within around 5 percent of that transported by FCEVs or internal combustion engine vehicles (Basma et al 2023).

Are Hydrogen Trucks and Buses Available on the Market Today?

While there are well over 100 battery-electric heavy-duty trucks on the market today, heavy-duty commercial fuel-cell trucks and buses are very limited, and no hydrogen combustion trucks are slated for near-term commercial development. Although there have been reports of a handful of Class 8 long-haul fuel-cell tractor trucks from start-ups like Nikola and Hyzon, the only commercially available heavy-duty fuel-cell vehicles in the United States today are transit buses, all of which are in California (Canel 2023).

However, some of the largest ports in California have or will soon participate in demonstration projects of hydrogen fuel-cell trucks. The Port of Oakland, which is adjacent to communities historically and disproportionately impacted by air pollution, will begin testing Hyundai fuel-cell trucks to better understand the potential for these vehicles in drayage applications (CARB 2023).

The Economics Don’t Add Up for Large-Scale FCEV Deployment

Because of the significant hydrogen fuel costs, commercial on-road FCEV deployment is expected to occur in niche situations in which BEVs would not make sense economically or meet duty cycle demands. The most common current examples are freight routes with distances that make current BEV options technically or economically infeasible. Other niche examples could include vehicles traveling significant distances away from industrial corridors, such as logging trucks, or specialty vehicles with high energy demands.

When comparing FCEVs and BEVs, each fuel type has distinct advantages and disadvantages, and truck fleets will likely adopt whichever technology is most economical and best suits their use case. The benefits of FCEVs in trucking essentially reflect the challenges of BEVs, but given the rapid pace of developing technologies in clean vehicles, these benefits and challenges are anything but static.

The larger body of research presents mixed estimates of heavy-duty FCEV adoption in the future. Although a recent regulatory analysis by the California Air Resources Board estimated FCEVs would constitute around half of zero-emissions long-haul trucks toward the end of the decade, other studies have suggested that FCEVs will play a limited role even in long-haul trucking applications (CARB 2022a; Rout et al. 2022; Slowik et al. 2023). Studies that estimate a favorable total-cost of ownership for FCEVs compared to other vehicle types often rely on fuel cost assumptions that do not square with current retail hydrogen prices. For example, a 2022 study on total-cost of ownership of European alternative-fuel vehicles showed that 65 percent of FCEV long-haul tractor truck total costs are related to fuel expenditures (Rout et al. 2022). While this study suggests that FCEV trucks will have the lowest total-cost of ownership among the fuel types studied, it also assumes retail hydrogen fuel costs of around $2.10/kg, which is far lower than the $30/kg or greater seen at California pumps in 2023.

If hydrogen fuel prices do indeed decrease and stabilize as projected, adoption of FCEVs could make economic sense for more on-road commercial applications. However, given that nearly 90 percent of commercial vehicles travel less than 100 miles each day, battery costs continue to decline, and BEVs continue to increase in range and charging speeds, it is likely that BEVs will continue to make up most commercial ZEVs (Slowik et al. 2023; USCB 2004). Even in long-haul applications where hydrogen is often anticipated to be a significant player, potential adopters of the fuel may face uncertain and volatile fuel costs. As mentioned above, with the high cost of hydrogen fuel and rapidly advancing BEV technologies, FCEVs will likely not be widely adopted, even for long-haul on-road freight.

Comparing the Scalability of Hydrogen and BEV Fueling Infrastructure

Like BEVs, FCEVs will require a significant build-out of new fueling infrastructure. Outside of a few select neighborhoods throughout California, not many operational hydrogen fueling stations exist (CARB 2022b). In its 2023 Clean Freight Corridor Efficiency Assessment, the California Transportation Commission noted that between 15 and 20 publicly available hydrogen fueling stations will be needed by 2025 in California to support the first wave of zero-emissions long-haul trucks (CTC 2023). However, this estimate could be overstated, given that the study assumed higher early FCEV adoption rates than other studies have.

As with the vehicles themselves, hydrogen fueling infrastructure presents both challenges and opportunities related to construction, cost, and technology.

A consistent talking point among hydrogen vehicle manufacturers has been that the vehicles have a similar fueling experience to conventional fossil fuel vehicles, particularly reduced time, compared to current BEVs. Nikola, for example, advertises that its Class 8 fuel-cell tractor truck can fuel completely in as little as 20 minutes, giving it up to 500 miles of range.

This is a significant range upside compared to current battery-electric tractor trucks from legacy manufacturers, which can take around 90 minutes to charge enough to travel 200 miles. However, some Class 8 battery-electric models are beginning to catch up. Fleets testing the Class 8 Tesla Semi have reported the vehicles achieve nearly 500 miles of range in the real world, and Tesla claims they can regain up to 70 percent of charge in 30 minutes using their Megacharger (Kothari 2023).

Hydrogen fueling stations vary from both diesel and battery-electric fueling stations. Because hydrogen is stored as a compressed gas, the stations require significantly more hardware and, in turn, have higher construction costs. The California Transportation Commission estimates that a hydrogen truck fueling station will cost between $8.6 million and $12.6 million (not including fuel production), compared to between $5 million and $9 million for a battery-electric truck fueling station. While in the long-term hydrogen fuel may be delivered to stations through a distribution network of pipelines, near-term hydrogen fuel will most likely be delivered by trucks, unless the station is located adjacent to a production facility (DOE, n.d.; DOE 2023b). Hydrogen stations may not require the potential electric grid upgrades of battery-electric truck stops, but developing dedicated hydrogen delivery pipelines will be costly and time consuming. Hydrogen pipelines would reduce fuel trucking traffic and increase economic efficiencies of delivery, but demand for the fuel is unlikely to require pipeline-scale distribution volume until after 2030 (DOE 2023b). Furthermore, pipeline construction may present concerns around leaks and community and environmental impacts.

Because hydrogen is an indirect global warming pollutant, addressing potential fuel leakage is critical to FCEVs’ ability to help mitigate climate warming. A 2020 study estimated that leak rates during hydrogen vehicle fueling were between 2 and 10 percent (Genovese et al. 2020). While hydrogen gas itself is nontoxic and disperses rapidly, it has a 20-year warming potential over 30 times that of carbon dioxide (Sand et al. 2023). With the indirect warming potential of hydrogen and the emissions from its production, even a small amount of leakage could significantly compromise its effectiveness as a clean fuel. Despite a potential profit motive on the part of hydrogen stations and vehicle manufactures to reduce leaks, it is important that regulators ensure hydrogen fuel leaks are minimized throughout the system.

This is a condensed, online version of the report. For the full text and figures, please download the full report.

Downloads

Citation

Wilson, Sam. 2023. Hydrogen-Powered Heavy-Duty Trucks: A review of the environmental and economic implications of hydrogen fuel for on-road freight. Cambridge, MA: Union of Concerned Scientists. https://www.ucsusa.org/resources/hydrogen-powered-heavy-duty-trucks