Many fossil fuel power plants across the country are no longer economic to operate year-round.

Regardless, plant owners continue to burn coal or fossil gas when there are cheaper options—namely renewables—because public utility commissions allow them to charge their customers higher rates to cover their losses.

In 2019 alone, even when gas prices were at record lows, utilities in the 20 states covered by two electric grid operators—the Midcontinent Independent System Operator (MISO) and Southwest Power Pool (SPP)—socked their ratepayers for an extra $117 million.

Regulators should stop utilities from forcing ratepayers to cover the cost of uneconomic gas-fired plants and remove the obstacles preventing renewable energy from lowering costs and cutting emissions. Likewise regulators should reject any plans to build new, uneconomic gas-fired power facilities and encourage electricity providers to replace their existing uneconomic gas-fired power facilities with economic alternatives, including renewable energy sources, storage, and energy efficiency programs.

The Shaky Economics of Gas-Fired Power

This is an online version of the executive summary. For all figures and the full text, download the PDF

Falling wholesale electricity prices over the past decade have put increased pressure on the operating economics of power plants. Between 2008 and 2017, annual average wholesale electricity prices in regions across the country fell by $19 to $64 per megawatt-hour (MWh), driven by a period of low prices of methane gas and increases in low-cost renewable energy resources on the grid (Mills et al. 2021). (In this report we refer to natural gas as methane gas, or simply gas.) Such historical declines in wholesale electricity prices have made it harder for higher-cost thermal resources to be cost-competitive, and have led overall to decreases in operating hours, especially for coal and some gas–fired power plants (EIA 2020b; Sims et al. 2021; Shwisberg et al. 2021). However, despite this, some power providers still choose to operate thermal resources when their operating costs exceed market revenues and/or when lower-cost resources are available on the grid to run instead. Multiple studies in the past few years have found that coal plants were operating in wholesale electricity markets across the country when lower-cost resources were available on the market (Daniel 2017; Nelson and Liu 2018; Fisher et al. 2019; Glick 2020). More recent reports from select wholesale markets indicate that this problem may extend beyond coal plants to include gas-fired power plants as well (SPP MMU 2019; MISO 2020).

Reasons Behind Uneconomic Generation in Wholesale Markets

Competitive wholesale electricity markets, operated by independent system operators and regional transmission operators (ISOs/RTOs), are designed to use the lowest variable cost resources available to meet demand at every hour of every day, subject to local constraints of the grid (Figure 1). The expectation of a properly functioning wholesale market is that any power provider running its generators and selling electricity to the grid should be recovering its fuel and variable operating expenses.1

HOW MARKET BIDS ARE FORMED AND MARKET PRICES ARE SET

Utilities and other power providers craft bids into the market for each generator. Those bids are intended to cover the costs of running that generator at that time, and are submitted to grid operators for either the day-ahead or real-time energy market. Grid operators then evaluate the bids in light of expected demand for that period and begin to call the lowest-cost resources to operate, adding higher-cost resources until demand is met. The last resource used to meet demand is (presumably) the highest-cost resource being dispatched at that time and sets the market clearing price (see Figure 2). Market clearing prices are determined for specific locations within an RTO and account for various physical constraints of the grid, such as transmission constraints, minimum generator run times, and generators’ ramp rates (how quickly a plant, whether fossil fuel or renewable, can increase or decrease its power production).

In this way, the last generator added, which sets the price, will break even—its revenue from the market will equal its bid, which is meant to cover its fuel costs and variable operating costs. All other dispatched units cost less to operate but receive the same payment per unit of energy provided; these units should both cover their operating costs and earn surplus revenue that can be used to either pay off fixed costs or earn a profit.2

This process, in theory, leads to market participants acting rationally and creates an economically efficient system. If a utility or other power provider submits a bid below its generator’s operating cost and clears the market, it runs the risk of losing money. Conversely, if it overbids its operating costs, it runs the risk of not being called and missing the opportunity to make money.

As a result, power providers have an incentive to submit bids that accurately reflect their generators’ operating costs and to behave in the market as it was intended, which should lead to economically optimal results for the system as a whole. However, in practice, power providers can operate power facilities at times when they do not recover fuel and variable operating costs through market revenues alone, leading to higher costs for ratepayers and at times displacing cleaner-energy resources.

OPERATING OUT-OF-MERIT BY SELF-SCHEDULING AND SELF-COMMITTING

In each of the ISO/RTOs, there are mechanisms that allow power plants to skip in line, being dispatched before lower-cost and less polluting resources, known as operating out-of-merit.3

Certain practices allow a power provider to operate regardless of whether it recovers its costs. For example, all power providers have the option to “self-schedule” and “self-commit” resources into day-ahead markets rather than wait for their units to be dispatched by the system operator according to different units’ relative costs. Power providers are allowed to self-schedule their units onto the market at a pre-determined level of energy production and time period, either because the providers need to test equipment or in order to fulfill a power purchase agreement. Power providers may also self-commit their units by requiring that they operate continuously at a minimum, pre-determined level of energy production and be dispatched above that level only if the grid operator calls upon them based on their bid price.4 Reasons why some generators are allowed to self-schedule or self-commit include that they require an extended ramp-up time or long minimum operating times (more so for coal and nuclear plants). Regardless of the rationale, these practices allow a power provider to operate independently of whether it recovers its costs and independently of what market economics would suggest.

Both self-scheduling and self-commitment reduce grid flexibility and can create unnecessary costs for consumers. Their use can prevent grid operators from turning down or shutting down units that, based on market economics, should not be running. It also allows power providers to sell power at a loss and/or prevents lower-cost, cleaner resources from being used to meet demand.

SETTING BIDS ARTIFICIALLY LOW

In addition, power providers can choose to set their bids artificially low and bid into the market when operating costs are not being fully recovered. One way this can happen is when power plant operators improperly classify (either intentionally or accidentally) portions of their variable costs as fixed costs. For example, a utility might have a fuel contract that has a mix of variable costs (related to how much fuel it purchases) and fixed costs (numerous fees incorporated into the contract) and choose to account for the entirety of the contract as a longrun fixed cost. If plant operators improperly treat variable costs as fixed, they will not incorporate these costs into their market bids and will instead submit an artificially low market bid that does not encompass the full cost of operating. If then called to operate, they would run the risk of operating in place of cheaper resources and would be incurring unnecessary losses.

A utility might also operate a plant more than market economics would suggest (i.e., at a loss) to prove that the asset is “used and useful” to regulators. For ratepayers to pay for assets and for utilities to earn a return on them, power providers need to show that their assets are used and useful to ratepayers. If their assets do not pass this test, costs associated with them can be disallowed. Running a power plant more frequently than it should be allows utilities to continue receiving favorable returns on that asset from customers.

THE CONSEQUENCES OF INAPPROPRIATE DISPATCH OF GENERATORS

When power providers inappropriately dispatch their units at times when they do not recover their variable operating costs, they incur losses. If the power plant is serving captive ratepayers—customers of vertically integrated investor-owned utilities, electric cooperatives, and municipal utilities—those customers must cover the costs from inefficient and uneconomic operations. While state regulators can scrutinize imprudent operating decisions if the power provider is a regulated utility and disallow these costs in rate cases and fuel adjustment cases, operating decisions are not overseen by regulators for electric cooperatives, and disallowances for regulated utilities are rare. In both cases, ratepayers must absorb those costs, paying higher prices for more polluting energy sources.

The Emerging Problems with Gas

In 2020, gas-fired power accounted for 33 percent of generation in the U.S. power sector (EIA 2021). Utilities and fossil fuel interests have claimed that gas is cheap and clean when justifying the large-scale build-out of gas-fired facilities; however, mounting evidence shows those claims are specious, in part due to rising and volatile gas prices and more costcompetitive alternatives (Union of Concerned Scientists 2015; Tsao and Martin 2019; Gruenwald 2021).

ECONOMICS OF GAS-FIRED POWER PLANTS

Fossil fuel plants, including gas plants, carry substantial fuel and variable operating costs and typically have difficulty competing in short-term energy markets with clean energy resources, such wind and solar, which do not carry such substantial variable operating costs. Extracting, transporting, and burning fossil fuels (including methane gas) is much more expensive than utilizing renewable energy resources for power that can meet the same grid demands. The environmental and public health costs associated with burning fossil fuels push their costs even higher (De Alwis and Limaye 2021).

ENVIRONMENTAL IMPACTS OF GAS-FIRED POWER PLANTS

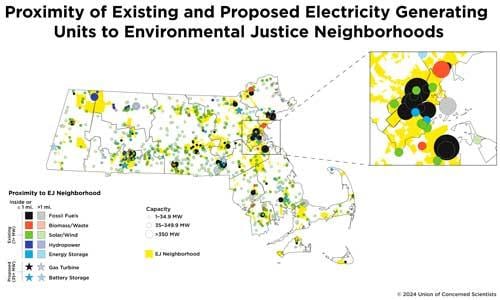

Methane gas is frequently touted as a cleaner fuel than coal, but being cleaner does not make it clean. Burning gas creates localized air pollution harmful to human health by generating nitrogen oxide (NOx) emissions, which can also react to form ozone and particulate matter through indirect processes (Donaghy and Jiang 2021). Since gas-fired plants tend to be in densely populated areas and in greater proximity to low-income communities and communities of color, an overreliance on gas for power exposes these communities to harmful pollution and has the potential to exacerbate existing disparities in pollution exposure from power plants (Thind et al. 2019; Diana, Ash, and Boyce 2021). From a climate perspective, methane gas is highly damaging—more than 80 times more potent of a heat-trapping gas than carbon dioxide over its first 20 years in the atmosphere. When accounting for upstream emissions resulting from leaks in gas distribution, burning gas instead of coal for power can have a similar or worse climate impact, negating any climate benefits from retiring coal power plants (Rives 2021).

The Importance of Evaluating Uneconomic Gas Generation

For power providers that operate in a monopoly environment, regardless of whether they participate in an RTO, there are numerous reasons and motivations used to justify operating fossil-fired plants uneconomically, creating unnecessary costs for ratepayers.

Uneconomic operations have been extensively studied and documented among coal plants, and it has been shown that coal resources have created estimated annual above-market costs of between $211 and $350 million in the Midcontinent Independent System Operator (MISO) alone and $136-173 in the Southwest Power Pool (SPP) (Daniel 2017; Fisher et al. 2019; Daniel et al. 2020). While there is emerging evidence that out-of-merit generation from gas plants is occurring in these two RTOs, no comprehensive or detailed evaluations focused on the gas fleet have been completed.

This analysis sought answers to the following questions about the gas fleet in MISO and SPP:

- How frequently are gas plants in these RTOs operating uneconomically?

- What additional costs are ratepayers paying?

- How do these calculations of the uneconomic operation of gas plants impact the way regulators and policymakers think about the clean energy transition (and whether there is a role for gas in it)?

If existing gas-fired plants are operating for long and/or frequent periods at a loss and are struggling to find consistent periods of time when it is economic to operate, newly proposed gas plants would face a serious risk of confronting the same challenges, as the underlining trends—rising levels of renewables on the grid, increased energy efficiency, and rising fuel costs—are likely to continue.

1. Another term for fuel and variable operating expenses is short-run marginal cost of dispatch. This excludes long-term fixed costs, which are not meant to be recouped from hourly energy market revenues.

2 Profits earned by independent power providers go to shareholders. Profits from vertically integrated monopolies go either back to ratepayers or to shareholders depending on local regulations.

3 There are also market protocols that allow the market operator to call on resources out-of-merit. This is usually reserved for resources with long lead times for start-up whose market cost offers would otherwise not clear in the market but which are needed down the road for reliability reasons. In this paper we are excluding resources with long lead times and reserve the term “out-of-merit” for resources whose owners self-select to operate out-of-merit.

4 This terminology is derived from the Midcontinent Independent System Operator’s market manual. Other ISO/RTOs have similar protocols, though sometimes use different terms to describe the practice.