The power grid is going through a transformation as states and utilities strive to achieve clean electricity goals.

Expanding the California grid operator into one that manages the power grid throughout the West could help California and the rest of the West meet their clean electricity benchmarks.

A western grid operator could improve access to renewable energy, bolster grid reliability, and coordinate transmission system planning, thereby reducing overall costs and global warming emissions. However, multiple risks and uncertainties come with expanding California’s grid operator into a regional one.

Ultimately, California policymakers must weigh the benefits against the risks as they set the course for the state’s power grid.

Transforming the Western Power Grid

This is a condensed, online version of the policy brief. For all figures, references, and the full text, please download the full policy brief PDF.

Introduction

California’s grid has faced an array of formidable challenges over the past few years. Summer electricity shortages, wildfires, escalating electricity rates, and clean resource deployment delays have all left California scrambling for solutions. The grid operator, state officials, and utilities have implemented a range of stopgap measures to bolster grid reliability, but many of these measures come with significant drawbacks, such as increased reliance on inefficient gas plants and highly polluting diesel backup generators.

As California decisionmakers consider longer-term solutions, they should prioritize those that advance a clean energy transition while maintaining affordability and grid reliability.

Policymakers should reconsider one solution in particular: partnering with other western states to create a region-wide grid operator and power market, an idea referred to as “grid regionalization.”1

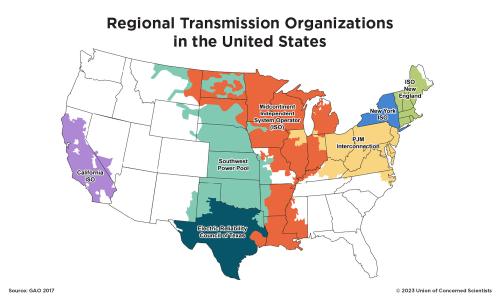

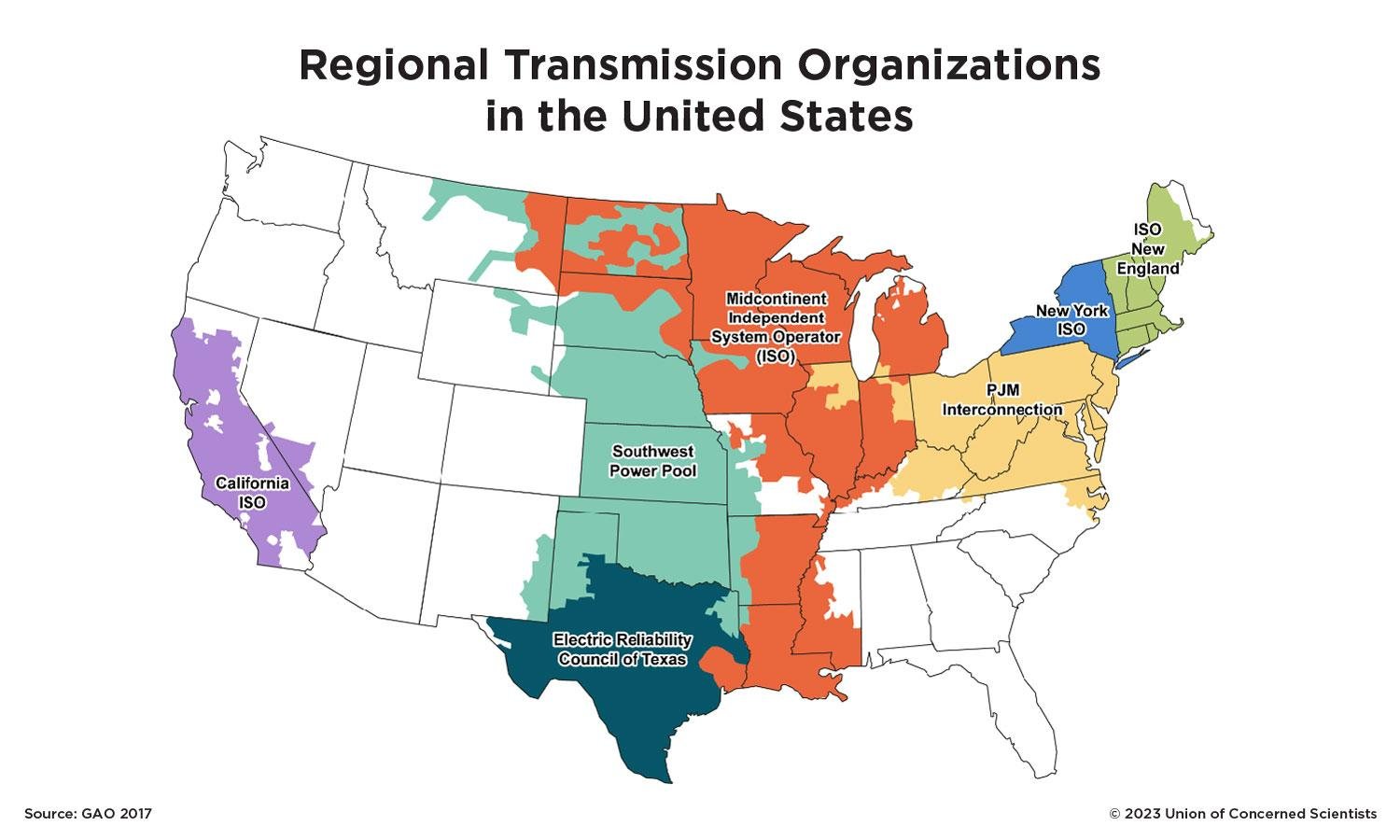

In 2018, California legislators considered a bill that would have created an independent governance structure for the state’s grid operator, the California Independent System Operator (CAISO; A.B. 813 2018). This change would have enabled the CAISO to expand its operations into other western states as a regional transmission organization (RTO), an independent entity that plans and operates the electricity grid.

While the bill did not pass, much has changed since 2018. As California grapples with the ongoing grid reliability concerns that emerged in 2020, the state has been coming to terms with the massive clean energy and transmission build-out required to achieve state goals, all while electricity rates steadily tick upward. Decisionmakers should give a second look to the expansion of the CAISO into a western RTO as an opportunity to address these issues.

Source: GAO 2017.

Opportunities and Benefits

Here, the Union of Concerned Scientists evaluates the formation of a western RTO in terms of three key criteria: (1) Does it enable the transition to clean electricity? (2) Does it bolster grid reliability? (3) Does it reduce overall grid costs?

AN RTO COULD STREAMLINE THE CLEAN ELECTRICITY TRANSITION

Many states and utilities in the West have made ambitious clean electricity commitments for the next few decades (NCSL 2021), and achieving these goals will require a significant and sustained build-out of clean energy resources. California law requires that the state transition to 60 percent renewable energy by 2030 and 100 percent carbon-free energy by 2045 (S.B. 100 2018).

To achieve the 2045 goal while accommodating growing demand due to the electrification of vehicles and buildings, California will need to build enough renewable energy and energy storage to approximately triple its current total electricity grid capacity (Gill, Gutierrez, and Weeks 2021). Consequently, around 6 gigawatts (GW) of new renewable energy and storage resources need to be built annually for the next 25 years. An average of 1.3 GW of solar and wind energy have been built annually over the past decade, indicating that the state must drastically increase the pace of its clean energy build-out.

FACILITATING TRANSMISSION BUILD-OUT

Coordinated regional transmission planning counts as an important advantage a western RTO has over other forms of western regional grid collaboration (see Box 1). In contrast to the patchwork of local transmission solutions that would be implemented under the current system, regional transmission planning could help ensure that western states invest in the most cost-effective transmission by simultaneously solving multiple issues across the region. To support California’s clean electricity goals, an estimated $30.5 billion will be needed to build out the transmission network over the next 20 years, with roughly one-third of that investment going toward transmission lines connecting out-of-state wind resources (CAISO 2022a).

A western RTO would be better positioned to plan a more intentionally designed regional transmission network to support the build-out of clean energy projects. The RTO would also maximize the cost-effectiveness of grid investments for all participating states.

LEVERAGING MARKET EFFICIENCIES

A regional grid could also enable western states to save more money with clean energy, by leveraging efficiencies through resource sharing and energy markets. Energy markets generally first dispatch resources with the lowest marginal cost of operation; those resources are often the cleanest. For example, California’s excess daytime solar could be dispatched to other states to reduce energy generation from fossil-fueled power plants, and excess hydropower in the Pacific Northwest could help support California’s grid after the sun sets and solar power tapers off.

These dynamics have already been observed in the CAISO Western Energy Imbalance Market (WEIM). The WEIM has led to meaningful reductions in renewable energy curtailment and global warming emissions (CAISO 2023a), and additional regional collaboration could increase these benefits even further.

AN RTO COULD BOLSTER GRID RELIABILITY

A western RTO could help bolster grid reliability in two ways: It could reduce capacity requirements and improve coordination during extreme weather events.

REDUCING CAPACITY REQUIREMENTS

First and foremost, an increased mix of consumers and suppliers in a single western RTO footprint could reduce the total capacity required to meet grid reliability needs. Studies have indicated that by 2030, California utilities would require 1.6–1.7 fewer GW of capacity (BEBA 2016; Energy Strategies 2021), which is a relatively small percentage of California’s total capacity needs (though it is certainly not negligible). Estimates for the entire West vary more widely, showing a reduction in the total required capacity of 4.3–11.9 GW (BEBA 2016; Energy Strategies 2021).

With reduced capacity requirements, either less new capacity would need to be built or existing capacity, such as fossil-fueled power plants, would no longer be required and could be shut down.

Box 1. Forms of Western Regional Collaboration

To capture the benefits of regional collaboration, California’s grid has become increasingly integrated with the rest of the West through multiple efforts to expand the geographical footprint of its energy markets.

The California Independent System Operator (CAISO) Western Energy Imbalance Market (WEIM) began operation in 2014, and voluntary participation among utilities has grown. The WEIM now covers nearly 80 percent of the load in the Western Interconnection (CAISO 2023b). As a real-time energy market, the WEIM optimizes the dispatch of generating resources on a subhourly level to accommodate unanticipated changes in the electricity demand forecast. Since its inception, the WEIM has reduced renewable energy curtailment by more than 1.8 million megawatt-hours and reduced CO2 emissions by nearly 800,000 metric tons (CAISO 2023a).

The CAISO Extended Day-Ahead Market (EDAM) is in the final stages of approval and has not yet begun operations. The EDAM day-ahead energy market will optimize the dispatch of generating resources on an hourly level to meet the electricity demand forecast for the next day. EDAM participation will be voluntary and open to any participant in the WEIM, though it is not yet clear how widespread participation will be. Analysis suggests that EDAM benefits will be much larger than those of the WEIM, but the magnitude of benefits will depend on the extent to which utilities participate in the EDAM.

In contrast to the WEIM and EDAM, a western RTO would do much more than operate real-time and day-ahead energy markets. Most importantly, an RTO would manage transmission planning and grid reliability, and coordination in those two areas could yield additional benefits. One study found that California could receive approximately 75 percent of the operational savings of a western RTO simply through participation in the EDAM (Energy Strategies 2022). However, this study did not quantify all RTO benefit types (such as benefits from coordinated transmission planning), and it included capacity savings that may not materialize solely from EDAM participation.

Overall, California may receive a significant portion of the benefits of western grid collaboration with widespread participation in the EDAM, but many of these benefits will be difficult to attain without further regional collaboration, such as participation in a western RTO.

COORDINATING DURING EXTREME WEATHER EVENTS

During periods of stressed grid conditions, a western RTO could bolster grid reliability through increased coordination.2 For example, during California’s September 2022 heat wave, the CAISO cited coordination with neighboring balancing authorities as a factor that helped avert power outages (CAISO 2022b).

With much greater insight into generator availability and transmission constraints, an RTO could more effectively coordinate preparations for extreme weather or other multiday challenges to reliability. Furthermore, a western RTO could plan the transmission system to facilitate this type of resource sharing better during stressed grid conditions.

AN RTO COULD REDUCE OVERALL GRID COSTS

Recent history has demonstrated that regional grid collaboration can result in cost savings. For example, participation in the CAISO’s WEIM has resulted in nearly $1.3 billion in savings for California since 2014, with total savings across the West reaching $3.4 billion (CAISO 2023a). While these savings are relatively modest, a western RTO could produce much more significant savings for California and the rest of the West3. Estimates of annual benefits to California by 2030 range from $500 million (when counting only savings from more efficient energy dispatch and from reduced capacity requirements; Energy Strategies 2021) to $1.5 billion (when also counting reduced renewable energy procurement costs and reduced grid management charges; BEBA 2016).

In addition, an economic analysis indicates that these reduced grid costs would significantly increase economic activity and create many new high-paying jobs (Energy Strategies and Peterson & Associates 2022). Overall, the evidence confirms that a western RTO would reduce overall grid costs in California and the rest of the West. 3

Risks and Uncertainties

Despite the many potential benefits of a western RTO, several important risks and uncertainties can arise in the implementation of a regional grid. While some of these uncertainties are hypothetical issues that may not materialize in practice, they are important to acknowledge so that the pursuit and design of a regional grid can safeguard against them.

REGIONALIZATION COULD AFFECT RENEWABLE ENERGY REQUIREMENTS

An RTO could affect the way California achieves its clean electricity goals, especially the state’s Renewables Portfolio Standard (RPS). California’s RPS requires renewable energy delivery into a California balancing authority. This requirement provides a major incentive for in-state renewable energy projects and helps ensure jobs in California.

However, if the CAISO expanded into a western RTO, out-of-state renewable power delivered to any part of the RTO would likely become eligible under current RPS rules. As a result, RPS requirements may no longer provide as much of an incentive for in-state renewable energy projects. Furthermore, out-of-state projects may not actually deliver energy into California to meet the state’s electricity demand, which could perpetuate reliance on in-state gas power plants.

With many western states and utilities required to reach 100 percent clean electricity, there may be limited opportunities for utilities to meet those requirements with clean energy projects located elsewhere in the West. Nonetheless, state policymakers will need to consider the consequences of potentially not being able to require delivery of renewable energy into California to meet RPS or other clean energy goals.

THE EFFECT ON GAS POWER PLANT RETIREMENTS IS UNCERTAIN

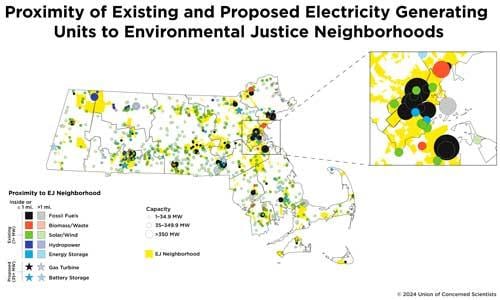

There are additional questions about how an RTO would affect the need for gas power plants in California. Retirement of these plants reflects an important environmental and environmental justice priority. A western RTO could modestly reduce overall capacity requirements due to the increased mix of consumers and suppliers. This could lead to additional gas power plant retirements, but no guarantee exists that plants in disadvantaged communities would be the ones that shut down. Even if California no longer needed power plants at the overall system level, local grid reliability requirements effectively force many California gas power plants to remain online.

If California policymakers wish to accelerate the retirement of gas power plants or prioritize the retirement of plants in disadvantaged communities, additional policy changes and planning processes would be required. The formation of a western RTO is not likely to significantly affect the need to retain existing gas power plants for grid reliability, but an RTO would be a critical stakeholder in developing alternative solutions that allow for the retirement of power plants.

A NEW GOVERNANCE STRUCTURE WOULD ALTER WHO MAKES DECISIONS

The western RTO governance structure constitutes one of the key issues in the grid regionalization discussion. For the CAISO to expand its operations into the rest of the West, California must pass legislation to allow the CAISO to transition to a new governance structure. The creation of an independent governance structure is a necessary step for utilities outside of California to join a western RTO. However, significant uncertainty exists around the design of a new governance structure and its implications.

Currently, California’s governor appoints the CAISO’s board of governors, and the state senate confirms appointees. While the CAISO board is technically independent in its decisionmaking, California policymakers can still influence the CAISO’s policy outcomes through the appointment process. Transitioning to a western RTO with a governance structure free of political appointees would remove this layer of oversight. Consequently, problematic policies could be adopted, for example, those that interfere with the transition to clean electricity.

In an RTO with independent governance, after the board of governors and the Federal Energy Regulatory Commission approve of a particular policy change, limited recourse exists to change direction. Recent history has demonstrated that industry-driven RTO policy changes can indeed negatively impact the clean energy transition (Reiser 2022).

Across existing RTOs, board composition and decisionmaking processes vary widely. Most RTOs organize stakeholders into sectors, such as transmission owners, electricity generators, and end-use customers. When making decisions, RTOs allocate a certain number of votes to each sector. In some RTOs, environmental and public interest groups have their own sector, and in others, such interests are not represented. Some RTOs require stakeholder sectors to approve new policies, and others simply count stakeholder votes as advisory. Due to this variety, a group of electricity regulators in the western states created a set of governance principles to protect customers and support state policy mandates in the western electricity grid (State Electricity Regulators 2022). These principles include having a committee to represent state interests, an independent and diverse board, and meaningful and open stakeholder engagement. Embedding these types of governance principles in a western RTO would significantly mitigate risks to a clean energy future.

THE WESTERN GRID MAY ORGANIZE WITHOUT CALIFORNIA

The western grid is reorganizing, and California must consider what role it would like to play in the new landscape. Thus far, California has led the way in organizing western utilities. The CAISO has seen widespread participation in its WEIM, serving as a proof of concept of the benefits from regional cooperation. The success of the WEIM and the trust that has been built with its participants lend a strong foundation for participation in the Extended Day-Ahead Market (EDAM) and, perhaps eventually, full participation in an RTO.

However, some western states and utilities have started to organize without California, and the state risks being left behind. For example, the Southwest Power Pool (SPP), an RTO operating in many of the plains states, now offers a suite of options to utilities in the West. SPP began operating its real-time energy imbalance market in 2021, is actively developing a day- ahead energy market within its Markets+ offering (which would directly compete with EDAM), and recently approved full RTO expansion into the Western Interconnection.

Another recent example of sans California collaborations comes from the Western Power Pool. This coalition of utilities across the West organized the Western Resource Adequacy Program to more effectively share resources and ensure grid reliability across a broad swathe of western states. Finally, Colorado and Nevada have state laws requiring certain utilities to join an RTO by 2030, and if SPP stands as the sole RTO operating throughout the West, those utilities may only have one choice.

All of this indicates that, with other offerings available, California may see some of its collaborators peel off to join other organizations, especially if the state chooses not to enable the expansion of the CAISO into a western RTO. As time goes on and these various forms of western grid collaboration mature, California may lose its ability to influence the design and governance of these systems. California policymakers must therefore consider how best to link the state’s grid with the rest of the West before western utilities organize without California.

Conclusion

California’s grid faces numerous challenges, such as the clean energy build-out required to achieve state goals, rising electricity rates, and grid reliability shortfalls. A western RTO presents many opportunities to address these challenges and facilitate the transition to a clean, reliable, and affordable energy future for California and the broader region.

However, policymakers must balance these opportunities against the uncertainties and risks that come with expanding the CAISO, along with the risk that the state could be left behind if policymakers maintain the status quo and the rest of the West organizes without California. While the benefits of regional cooperation are evident, determining which challenges would actually arise in the transition to a western RTO remains much more difficult.

This is a condensed, online version of the policy brief. For all figures, references, and the full text, please download the full policy brief PDF.

Downloads

Citation

Specht, Mark and Vivian Yang. 2023. Transforming the Western Power Grid: California Implications of Grid Regionalization Cambridge, MA: Union of Concerned Scientists. https://www.ucsusa.org/resources/transforming-western-power-grid