Analysis by the Union of Concerned Scientists (UCS) shows that federal tax credits are an effective near-term path for expanding renewable energy.

Using an energy planning model developed by the National Renewable Energy Laboratory, UCS energy experts examined the electricity sector provisions of several proposed bills to determine their impact on accelerating the momentum away from coal and gas in the US power sector.

We found that each of the proposed policies would spur increased use of renewable energy and reductions in carbon emissions. We concluded that the Clean Energy for America Act—a technology-neutral tax credit—would achieve the greatest increase in renewable energy capacity and the deepest reductions in both carbon and toxic air pollutants.

Federal Clean Energy Tax Credits

Federal tax credits for renewable energy have proven to be an effective near-term policy, delivering significant economic benefits across the United States, yet Congress has historically put these benefits in jeopardy by allowing the tax credits to lapse. New analysis by the Union of Concerned Scientists (UCS) of clean energy tax credit provisions in congressional bills demonstrates how a long-term extension of these tax credits would be good for both the economy and the environment.

In combination with state clean energy policies, federal tax credits have driven growth in the US wind and solar industries, created new jobs, lowered costs, and provided important climate and public health benefits by reducing emissions from fossil fuels (Clemmer 2017). They have also helped renewables compete with fossil fuels, which have benefited from large, decades-long federal subsidies and market prices that do not reflect many of the “external” costs of burning fossil fuels, from air pollution and its related health effects to climate change.

Congress has extended the tax credits for short periods of time and has allowed them to expire on several occasions. This policy uncertainty has created a boom-and-bust cycle of development, resulted in job losses and layoffs, and made it more difficult to plan and finance new projects. A long-term extension of the tax credits would allow the clean energy industry to maintain its growth and provide more parity and predictability in the tax code (Bailie et al. 2016; Clemmer 2017; Larsen et al. 2021).

To assess the impacts of such an extension on the US electricity sector, UCS analyzed the following three policies, each of which has different timelines and values for the credits themselves:1

- The Growing Renewable Energy and Efficiency Now (GREEN) Act of 2020, introduced by Representative Mike Thompson (D-California) and 49 colleagues, includes a five-year extension of the production tax credit (PTC) for wind at 60 percent of the full value through 2026, a 30 percent investment tax credit (ITC) for solar and energy storage through 2026, ramping down to 10 percent by 2028, and a 30 percent ITC for offshore wind through 2028.

- The GREEN Act Plus, a UCS-designed policy that has not been introduced in Congress, extends the tax credits in the GREEN Act for an additional five years, through 2031 for wind, solar, and storage and through 2033 for offshore wind, reminiscent of President Biden’s infrastructure plan proposal.

- The Clean Energy for America (CEA) Act of 2019, a technology-neutral tax credit proposal introduced by Senator Ron Wyden (D-Oregon) and 25 colleagues, extends the PTC for wind and solar at the full value, and includes a 30 percent ITC for new renewables, storage, nuclear, and carbon capture and storage (CCS), ramping both down over a four-year period once the power sector’s carbon dioxide (CO2) emissions reach 50 percent below 2019 levels (which we project will happen in 2034).2

We found that each of these policies can continue the recent momentum in deploying renewable energy and cutting the power sector’s carbon emissions. We also found that these policies can provide economic and health benefits across the country.

Our analysis used an energy planning model developed by the National Renewable Energy Laboratory to examine the effects of these tax credit extensions on the power sector (Cohen et al. 2019). To quantify their additional costs and benefits, we compared them with a reference case baseline that assumes no additional policies beyond the current state and federal policies enacted through July 2020 and includes the federal tax extenders passed by Congress in December 2020 (NREL 2019).

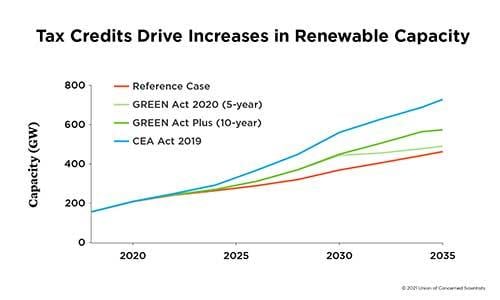

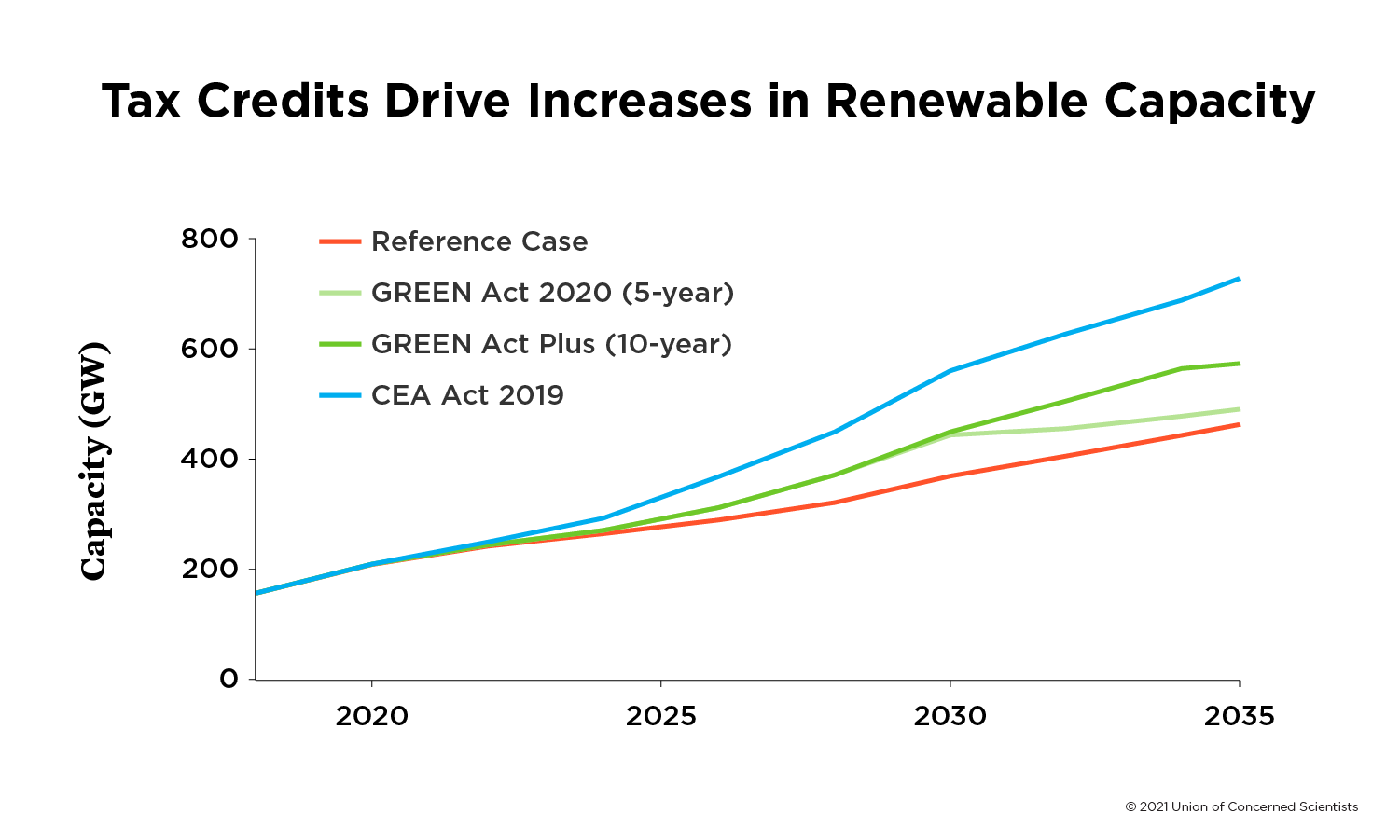

Federal tax credits help diversify the electricity mix

The GREEN Act spurs 74 gigawatts (GW) more wind and solar capacity by 2030 than the reference case (Figure 1). Extending the tax credits for an additional five years under the GREEN Act Plus results in 111 GW more wind and solar capacity by 2035. The CEA Act drives even higher levels of wind and solar: 191 GW of additional capacity by 2030 and 265 GW by 2035, or nearly 60 percent more than the reference case. This projected level of development would stimulate new capital investments ranging from $41 billion between 2020 and 2035 under the GREEN Act to $177 billion under the CEA Act. While we also included the tax credit extension for incremental hydropower, biomass, geothermal, and CCS, it did not result in any additional capacity for these technologies because they were not cost-effective compared with new wind and solar.

The timeline and the value of the PTC affects the impact of the policy. We see more renewable capacity being built under the GREEN Act Plus than under the GREEN Act because the policy is in effect for five additional years. We see even more renewable capacity under the CEA Act because of the increase in value of the PTC from 60 to 100 percent. The PTC eventually becomes more valuable to solar than the ITC as the capital costs for building solar continue to decline. By 2035, battery storage capacity increases by 9 GW under the CEA Act as wind and solar generation reach higher levels and storage costs decline.

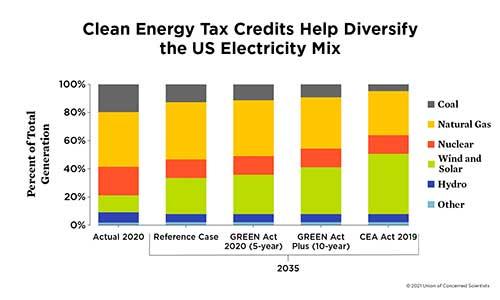

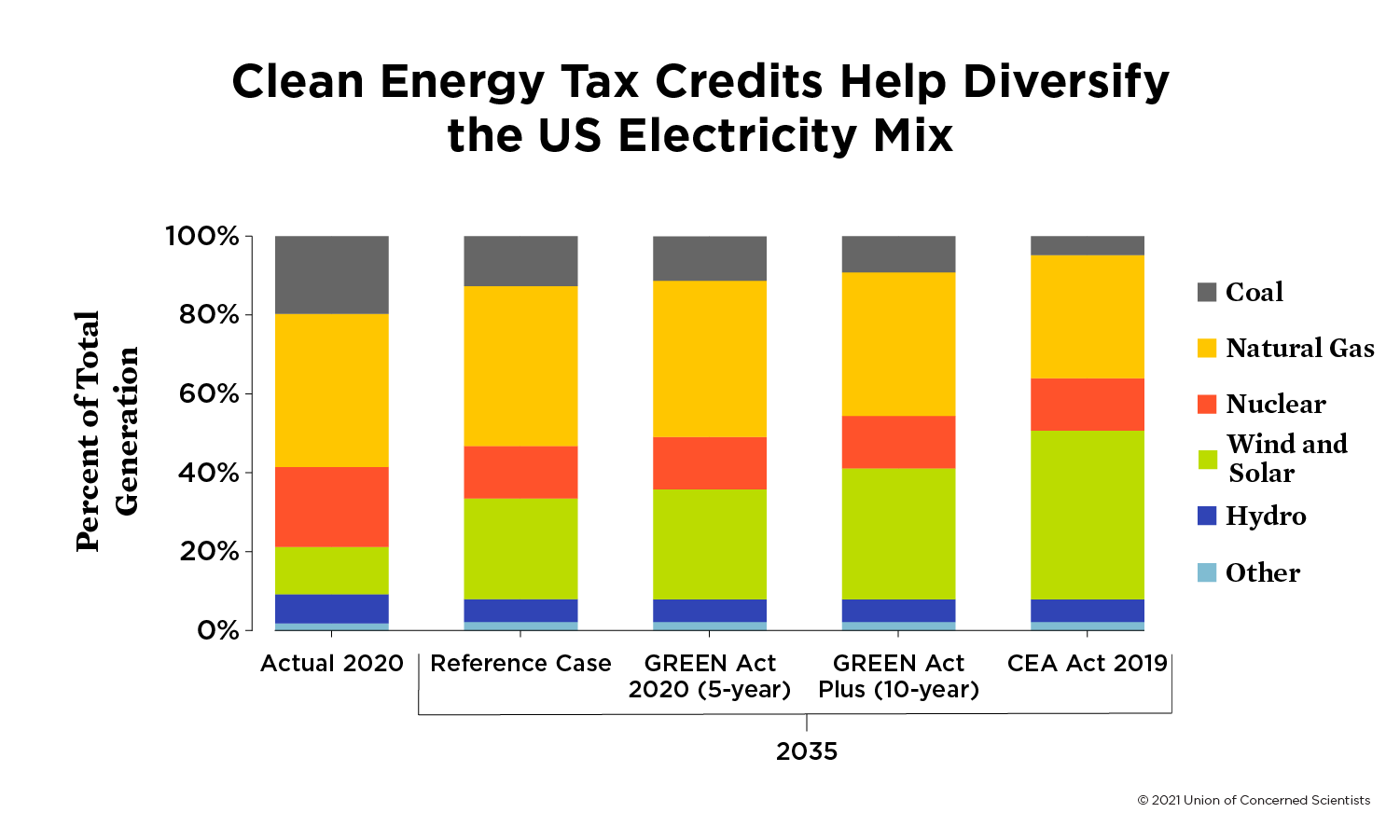

The renewable capacity built due to these tax credits displaces coal and gas, diversifying the US power supply. Under the CEA Act, renewable energy sources account for nearly half of total US power generation by 2035, more than double their share today, and total carbon-free generation grows from 40 percent in 2020 to 62 percent by 20353 (Figure 2). As renewable generation expands, generation from fossil fuels declines. Under the CEA Act, coal generation is 62 percent lower than the reference case by 2035 and gas generation is 23 percent lower.

As we transition away from coal, we must also limit the amount of new gas capacity being built, which has its own climate, health, and economic risks. Under the CEA Act, renewables displace 47 GW of new gas capacity by 2035, representing 64 percent of all new gas capacity projected to be built under the reference case.

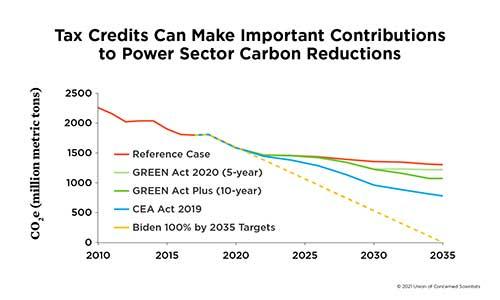

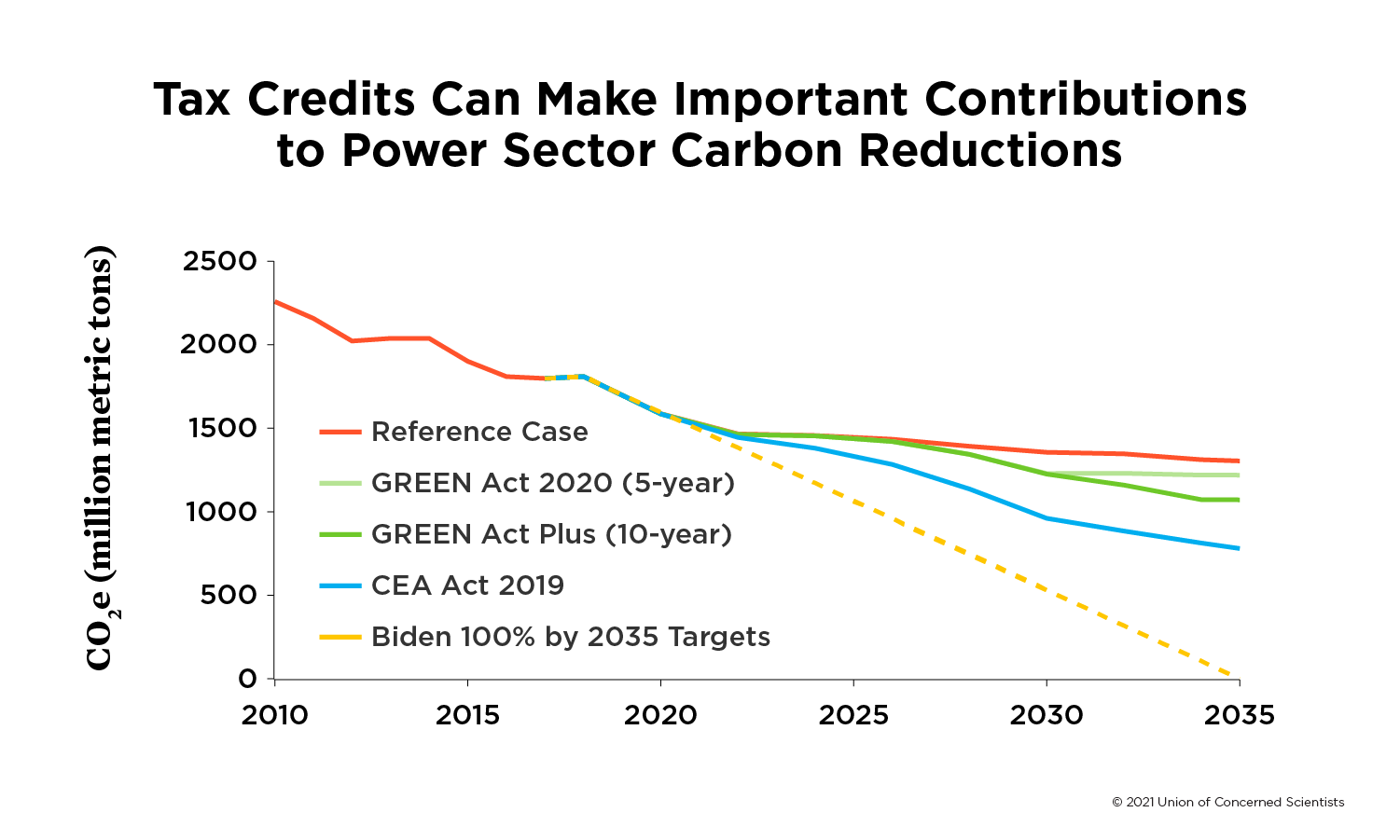

Tax credits reduce carbon emissions

As coal and gas generation decline, the power sector’s CO2 emissions drop. The tax credits considered here can make important contributions to these reductions: the GREEN Act reduces carbon 9 percent below the reference case by 2030 (Figure 3). The CEA Act, with its higher value for the PTC and its longer duration, results in a 29 percent reduction by 2030 and a 40 percent reduction by 2035.4 This would be a good start in putting the United States on a path to limit the worst impacts of climate change, but we need additional policies to achieve President Biden’s goal of 100 percent carbon-free electricity by 2035.

Health and economic benefits

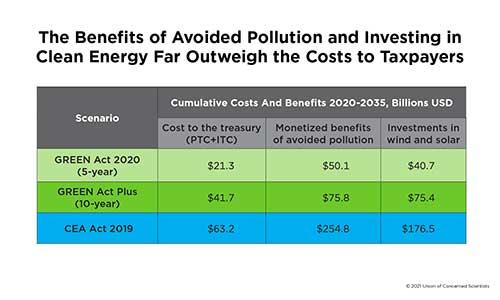

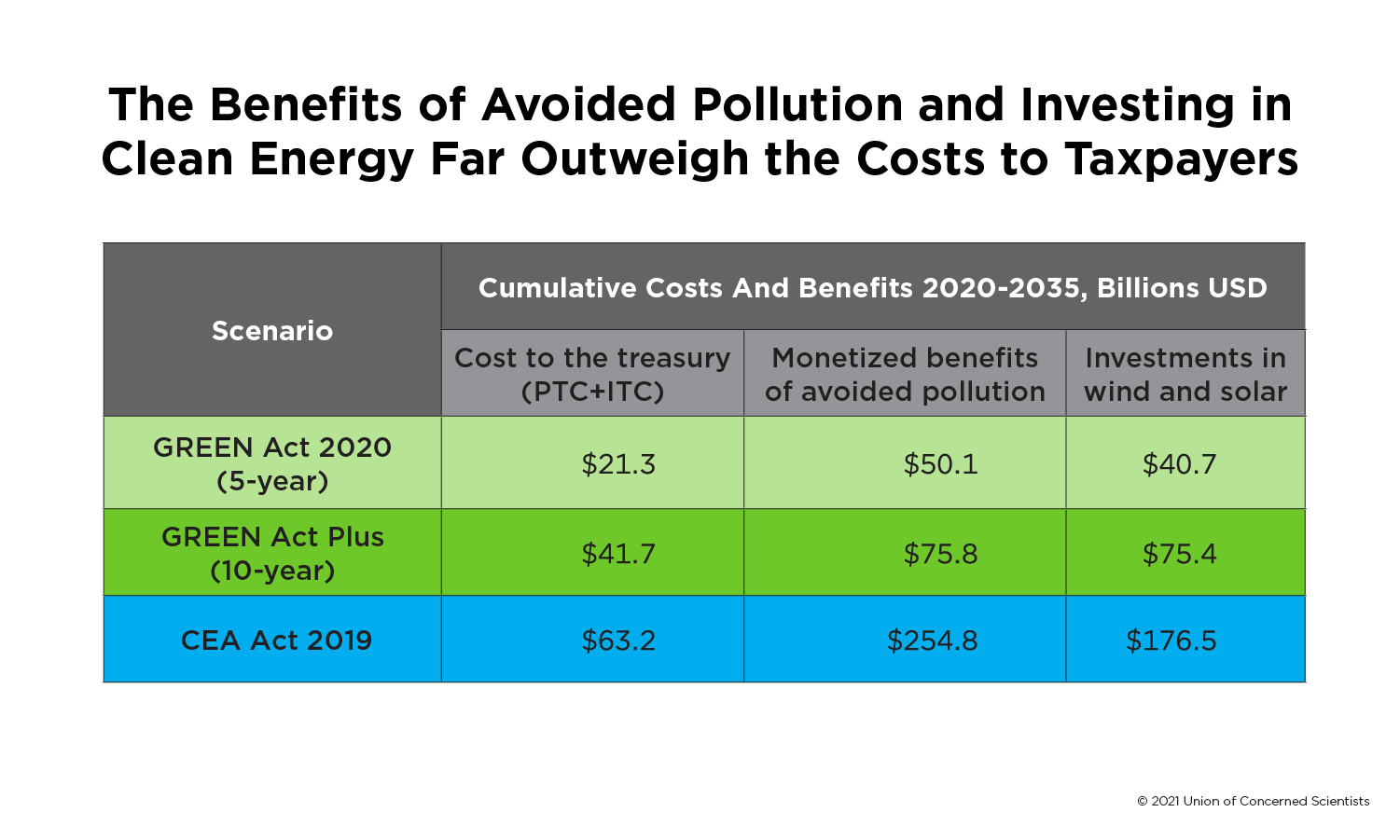

While all three proposals reduce toxic air pollutants from the power sector by reducing coal and gas generation, the CEA Act achieves the greatest and quickest reductions, cutting sulfur dioxide (SO2) emissions 61 percent and nitrogen oxide (NOx) emissions 54 percent below 2020 levels by 2030. These pollutants disproportionately impact communities of color and low-income communities that often have polluting facilities sited in their vicinity, and reducing toxic emissions quickly can lead to immediate health and economic benefits, such as fewer asthma attacks in children, heart attacks, hospital visits, missed school and work days, and fewer premature deaths from lung disease and other respiratory ailments (Desikan et al. 2019). The CEA Act, for example, would avoid more than 7,000 premature deaths through 2035 (Thind et al. 2019; Phadke et al. 2020). In monetary terms, the benefits of reducing CO2, NOx, and SO2 emissions range from $50 billion under the GREEN Act to $255 billion under the CEA Act (EPA 2018).

Our analysis shows that the health and economic benefits of avoided pollution from the proposed tax credits can far outweigh the estimated costs5 (see the table). The economic benefits are even greater when considering the new jobs, income, and tax revenues that investments in wind and solar can create, which could be used to help fossil-fuel-dependent communities make the transition to a clean energy economy. We also found that the increase in renewable energy would put downward pressure on electricity prices, resulting in slightly lower electricity bills for households and businesses.6

Building a carbon-free economy with benefits for all

Federal tax credits have been an important complement to state policies in promoting renewable energy development, creating jobs, lowering costs, and reducing emissions. Until the United States has national policies in place that provide more stable, long-term support for low-carbon energy, Congress should extend the federal tax credits by 10 years and at full value; this would maintain the clean energy industry’s growth and provide more parity and predictability in the tax code. Tax credits should also be expanded to encourage investments in energy storage, which would accelerate deployment and reduce costs. In light of the current economic crisis due to the COVID-19 pandemic, direct payments should also be made (as proposed in the GREEN Act and the reintroduced CEA Act) to spur renewable energy development.

To achieve a carbon-free power sector by 2035, we will need to continue to push for more ambitious policies that align with the scale of the climate crisis. Congress must not only pass ambitious tax incentives for renewable energy and extend existing tax credits, but also use these incentives as the foundation on which to build a just and equitable transition to a clean energy economy.

Endnotes

- For the Growing Renewable Energy and Efficiency Now (GREEN) Act of 2021 (H.R. 848), see https://www.congress.gov/bill/117th-congress/house-bill/848/text?r=6&s=1. For the Biden infrastructure plan proposal, see https://www.whitehouse.gov/briefing-room/statements-releases/2021/03/31/fact-sheet-the-american-jobs-plan/. For the Clean Energy for America Act, or the “Wyden proposal” (S. 1288), see https://www.congress.gov/bill/116th-congress/senate-bill/1288/text.

- Senator Wyden reintroduced his bill on April 21, 2021, with some new provisions and improvements. In the new version, only facilities with zero or net negative emissions are eligible to receive the incentives, and power and grid improvement projects have the option to claim the tax credits as direct payments. The new bill will also drive additional emissions reductions, with the credits phasing out after the power sector’s emissions reach 75 percent below 2021 levels, compared with the 2019 bill’s threshold of 50 percent below 2019 levels. Additional incentives are also available to locate projects in low-income communities, and projects are required to provide prevailing wages and apprenticeship opportunities.

- Electricity capacity is the maximum level of electric power that a power plant can supply at a specific point in time, while generation is a measure of electricity produced over a period of time.

- This represents a 60 percent reduction below 2005 levels by 2030 and a 68 percent reduction by 2035.

- Cumulative undiscounted costs from 2020–2030 range from $84 billion for the GREEN Act to $109 billion for the GREEN Act Plus to $104 billion for the Wyden proposal. Cumulative undiscounted costs from 2020–2035 for the Wyden proposal are $153 billion.

- Renewable energy generation technologies reduce electricity prices because they have low variable costs and no fuel costs. Decreasing natural gas use also lowers natural gas prices, which in turn lowers electricity prices.

- Cumulative results are the net present value 2020$ using a 7 percent discount rate; results are the differences between the reference case and the policy scenario. The calculated costs to the Treasury do not include distributed solar and battery technologies. By 2035, there are incremental additions of 10-13 GW of new distributed solar and batteries above the reference case across policies, which represent a small fraction (5-9 percent) of clean energy capacity additions eligible for the tax credits.

References

Bailie, A., J. Deyette, S. Clemmer, R. Cleetus, and S. Sattler. 2016. Accelerating toward a clean energy economy. Cambridge, MA: Union of Concerned Scientists. https://www.ucsusa.org/sites/default/files/attach/2016/05/national-clean-power-plan-analysis-update.pdf

Clemmer, S. 2017. “Federal renewable energy tax credits: Creating American jobs and investment in state and local economies.” Testimony before the Subcommittee on Energy, Committee on Energy and Commerce, US House of Representative’s hearing on “Federal Energy Related Tax Policy and its Effects on Markets, Prices and Consumers.” March 29, 2017. https://docs.house.gov/meetings/IF/IF03/20170329/105798/HHRG-115-IF03-Wstate-ClemmerS-20170329.pdf

Cohen, Stuart, Jon Becker, Dave Bielen, Maxwell Brown, Wesley Cole, Kelly Eurek, Will Frazier, et al. 2019. Regional Energy Deployment System (ReEDS) Model Documentation: Version 2018. Golden, CO: National Renewable Energy Laboratory. NREL/TP-6A20-72023. https://www.nrel.gov/docs/fy19osti/72023.pdf

Desikan, Anita, Jacob Carter, Shea Kinser, and Gretchen Goldman. 2019. Abandoned science, broken promises: How the Trump Administration’s neglect of science is leaving marginalized communities further behind. Cambridge, MA: Union of Concerned Scientists. https://www.ucsusa.org/resources/abandoned-science-broken-promises

EPA (Environmental Protection Agency). 2018. “Estimating the benefit per ton of reducing PM2.5 precursors from 17 sectors.” Technical support document. Research Triangle Park, NC: Office of Air and Radiation, Office of Air Quality Planning and Standards. https://www.epa.gov/sites/production/files/2018-02/documents/sourceapportionmentbpttsd_2018.pdf

Larsen, J., B. King, H. Kolus, and W. Herndon. 2021. Pathways to build back better: Investing in 100% clean electricity. https://rhg.com/research/build-back-better-clean-electricity/ NREL (National Renewable Energy Laboratory). 2019. 2019 Annual technology baseline. Golden, CO. https://atb.nrel.gov/electricity/2019

Phadke, A., U. Paliwal, N. Abhyankar, T. McNair, B. Paulos, D. Wooley, and R. O’Connell. 2020. 2035 the report: Plummeting solar, wind, and battery costs can accelerate our clean electricity future. Goldman School of Public Policy, University of California, Berkeley. https://www.2035report.com/electricity/

Thind, M.P.S., C.W. Tessum, I.L. Azevedo, and J.D. Marshall. 2019. “Fine particulate air pollution from electricity generation in the US: Health impacts by race, income, and geography.” Environmental Science & Technology 53(23): 14010–14019. https://pubs.acs.org/doi/10.1021/acs.est.9b02527

Downloads

Citation

Sattler, Sandra, Ashtin Massie, Steve Clemmer, and Chloe Ames. 2021. Federal Clean Energy Tax Credits: A Vital Building Block for Advancing Clean Electricity. Cambridge, MA: Union of Concerned Scientists. https://www.ucsusa.org/node/14072